5 Ways to Use Your Economic Impact Payment

Many Americans have already received their Economic Impact Payment, but many more are expecting a check to arrive in the coming weeks. Review these suggestions to make the most of your economic relief check.

What To Do If You Suddenly Lose Your Income

In addition to filing for unemployment, there are other steps you can take to ease the stress of suddenly losing your income, such as contacting your landlord or mortgage company to inform them of your financial position. Read about five more ways to take control and better your financial situation.

4 Scams Your Business Might Not Detect

Hackers never take a day off and the coronavirus pandemic has created the perfect “work” environment for them. Keep your guard up against these four COVID-19 pandemic related scams targeting businesses. Be sure to share with your team so everyone can work together to protect your business from scammers.

Coronavirus Scams On The Rise

With the COVID-19 pandemic continuing to evolve, scammers are leveraging the situation to take advantage of businesses & consumers. It is important to be vigilant when receiving emails, texts & phone calls that may be scammers disguised as businesses & government agencies requesting personal information. Read on to learn more about the latest scams and how you can protect your finances.

Four Ways to Prepare for a Pandemic or Public Emergency

Being prepared for a pandemic or large scale emergency can help you avoid panic and reduce disruption to your daily life. Our latest blog shares four strategies to help you be financially prepared to withstand an emergency.

Videos

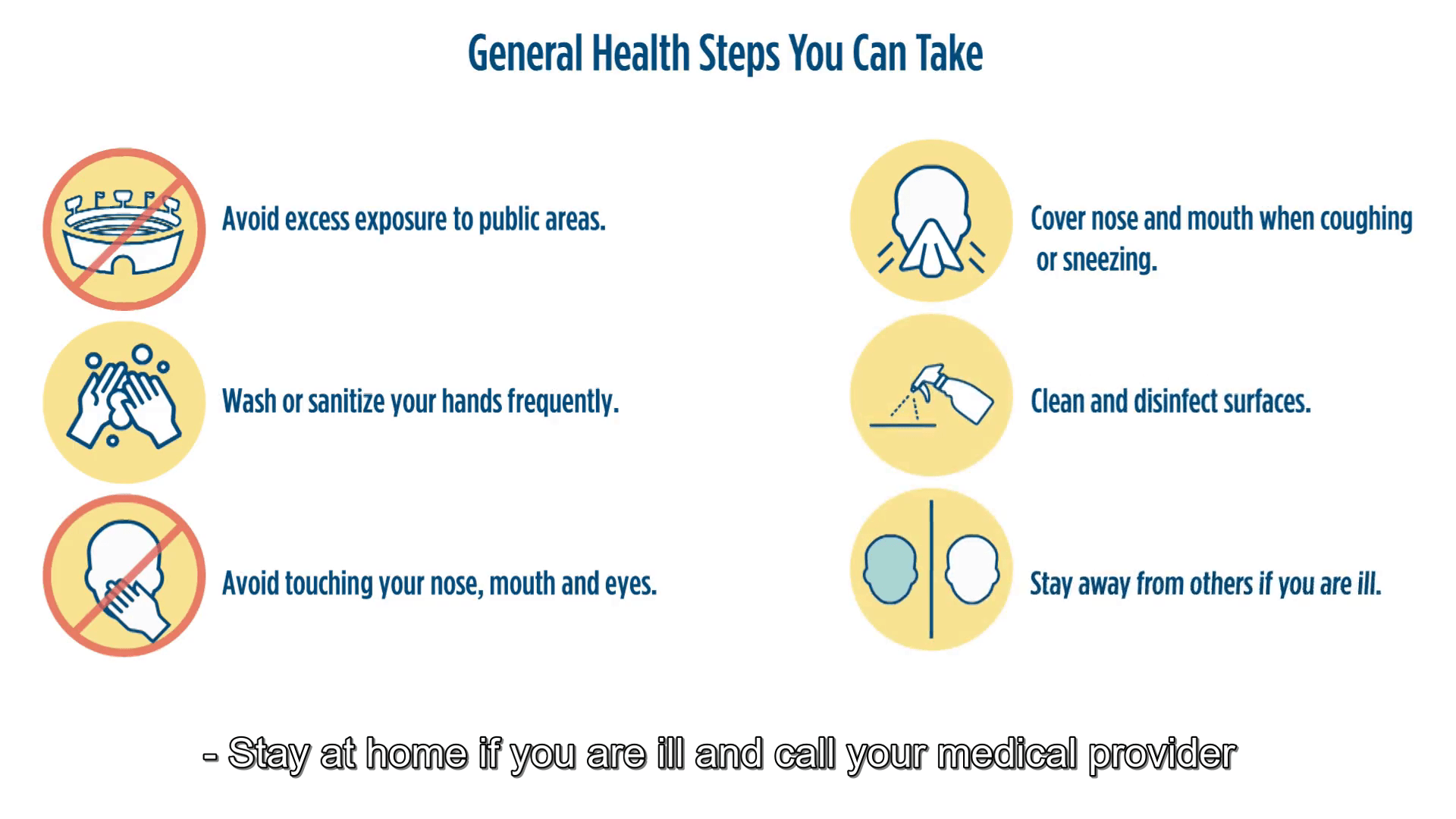

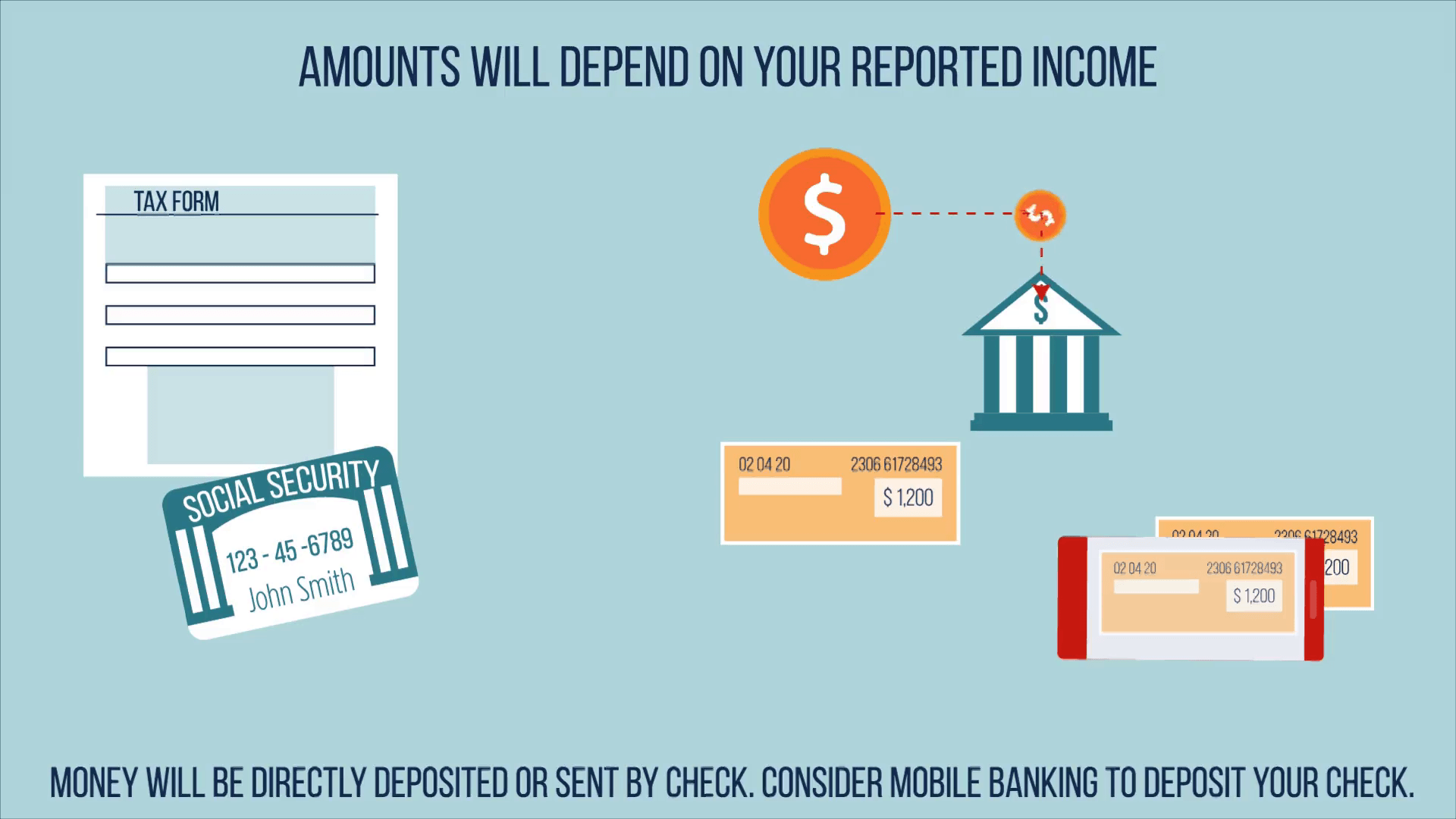

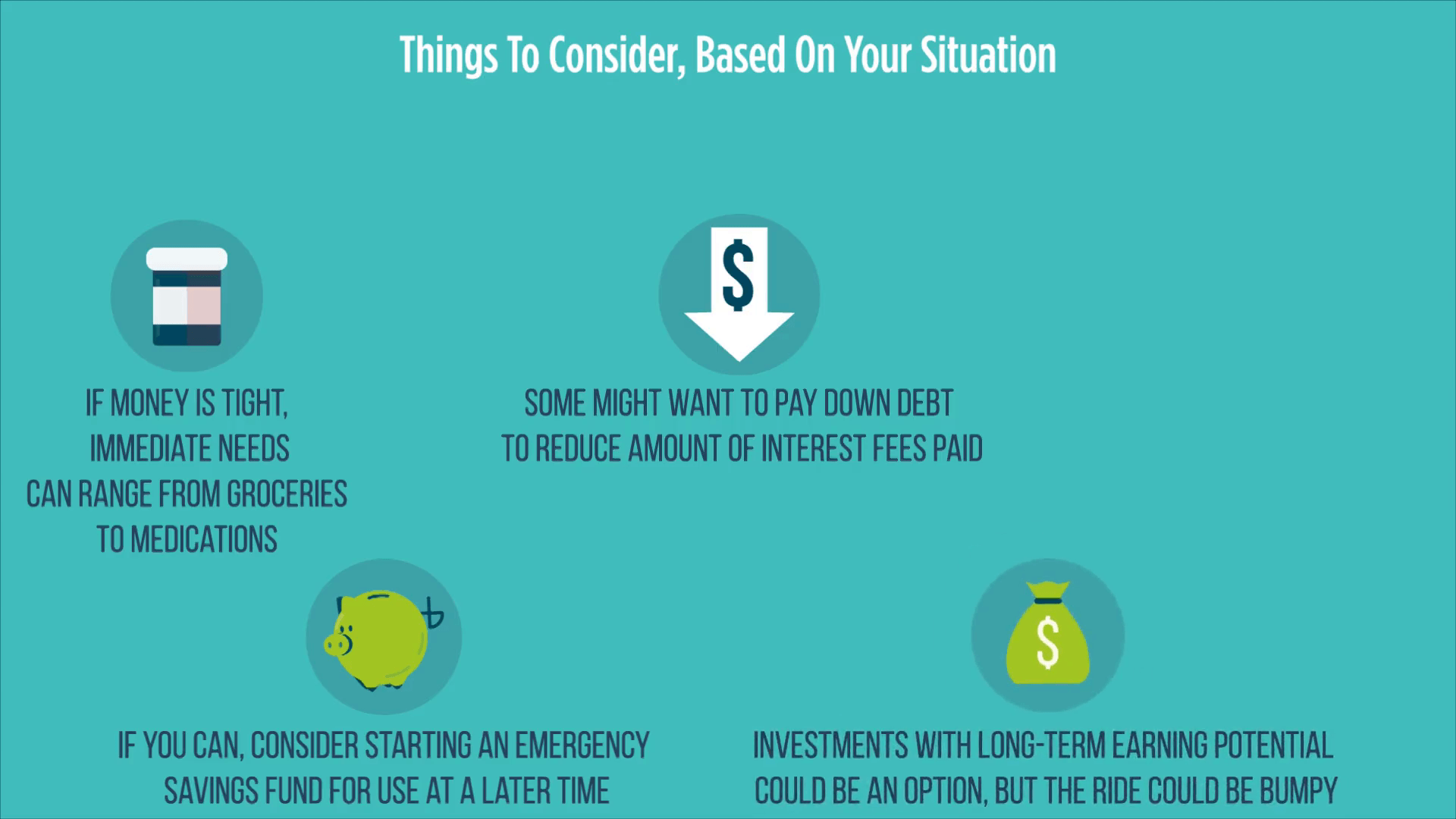

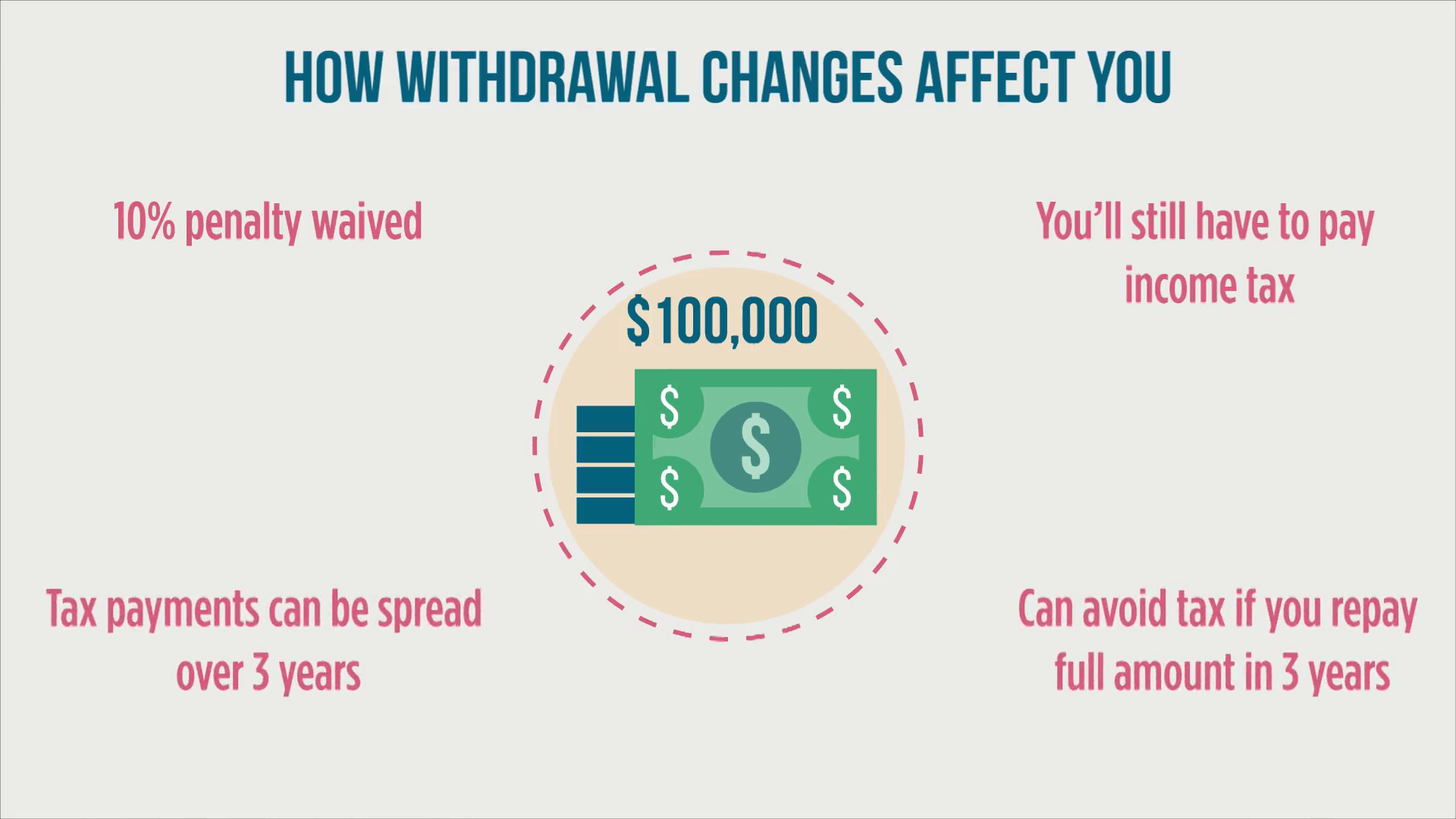

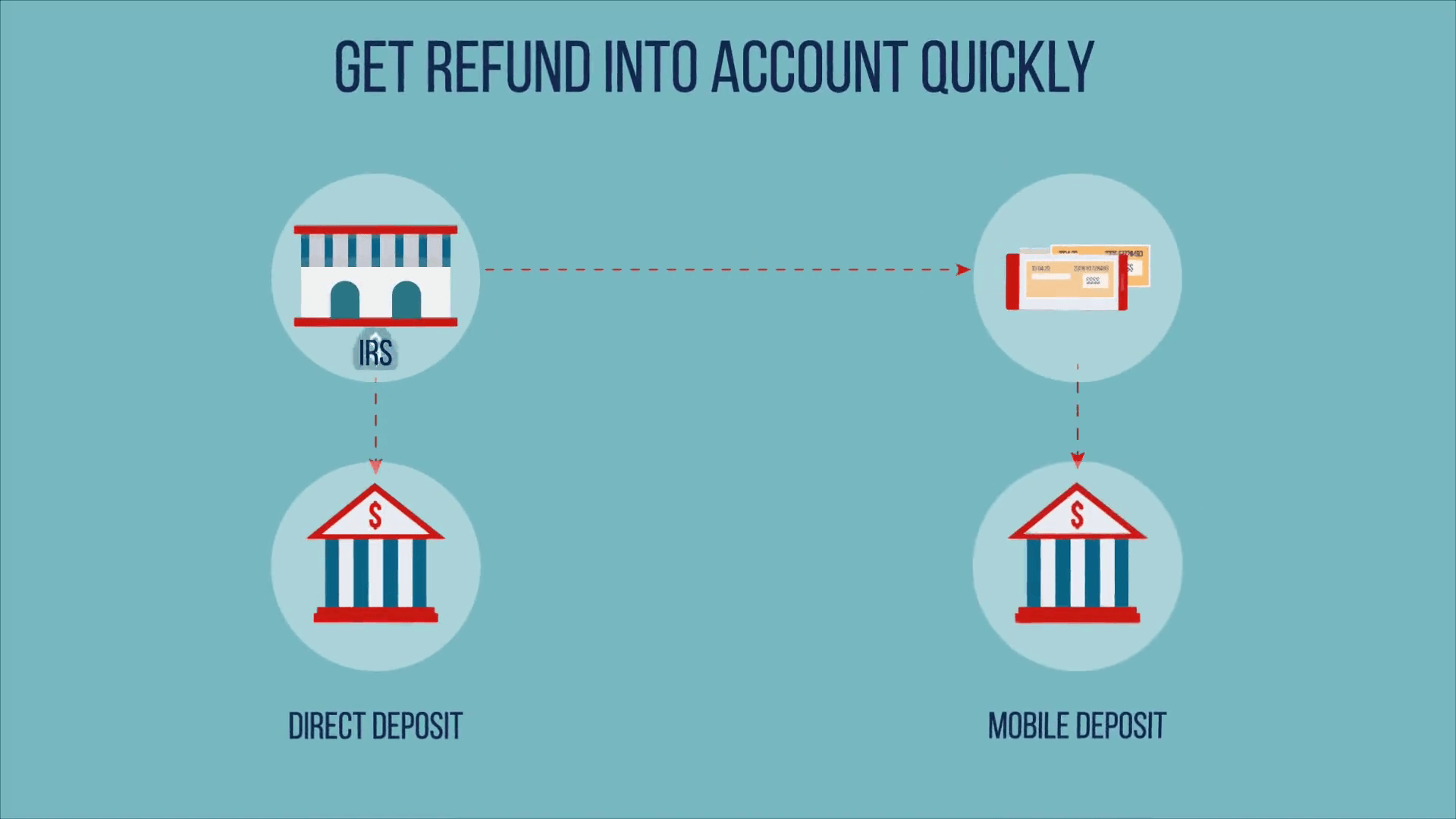

Coronavirus & Your Financial Needs The worldwide spread of the COVID-19 coronavirus has prompted health officials to strongly advise us all to minimize our exposure to possible infection. These advisories range from avoiding large gatherings to simple steps we can take to protect ourselves and others on a daily basis, such as how we go about our normal activities and how we meet our financial needs. Important general health steps from the Centers for Disease Control include: When it comes to meeting many of your money needs, your financial institution offers a variety of digital services through online and mobile banking. These steps can reduce your visits to a branch and the need to handle money or checks when out of your home. Online, mobile and other banking services include: For other banking needs or questions about services and steps being taken to protect you, visit your financial institution’s website or call their customer service number. The steps you take to protect yourself and others both at home and in public can minimize your exposure to COVID-19. Coronavirus & Flattening The Scam Curve With people nervous about the COVID-19 coronavirus, scammers already are swooping in to take advantage of those fears. While it’s normal to want to learn more about the coronavirus and information surrounding it, experts are warning people to be cautious of scammers who are trying to infect your devices with malware, get personal information from you, or who are trying to get you to send them money for worthless or non-existent products. There have even been reports of crooks threatening people over late or missed payments. According to the Federal Trade Commission and other experts, here are some of the scams to watch out for: Email phishing has already begun. Scammers are sending out emails claiming to be from the Centers for Disease Control or other health agencies, claiming to contain updates about the coronavirus. Consumers are being warned to be wary of these emails and not to click on any links or download any attachments unless they are absolutely sure of the source. Clicking on links or downloading attachments could install malware on your computer or take you to counterfeit sites where you might be asked to provide vital personal information. Some scammers claim to be selling products that can prevent the disease, treat it or maybe even make it go away. Don’t believe the claims. The FTC says there are currently no “vaccines, pills, potions, lotions, lozenges or other prescription or over-the-counter products available to treat or cure Coronavirus … online or in stores.” Don’t fall for these claims and don’t send any money. You’ll either be mailed a worthless product or receive nothing at all. As more people suffer financial hardship due to reduced hours or loss of jobs, scammers are likely to be contacting them threatening to disconnect vital services such as utilities or communications unless you pay them immediately. Legitimate businesses won’t threaten you, won’t demand payment in cash, gift cards or wire transfers, and they won’t ask for financial account numbers, your Social Security number, or account passwords. Some people are even posing as charities, hoping to rely on the kindness of others to steal your money. To guard against these scams, experts say to: While it’s natural to want to learn more about the coronavirus pandemic and to do what you can to protect yourself and others, it’s important to be cautious in order to protect yourself from scammers. Coronavirus Economic Relief Payment Millions of adults in the United States will automatically be receiving a payment of up to $1,200 as part of the federal economic relief plan to soften the blow from the coronavirus pandemic. The goal for delivery of the money is sometime in April. Eligibility will be based on reported income from your 2019 tax return if you have already filed, or your 2018 return if you have not filed for 2019. To be eligible, you also must have a Social Security number. The stimulus money will be directly deposited into your bank account if the IRS already has that information from your tax return, otherwise a check will be mailed to you. If you receive your check by mail, a fast way to get it into your account will be to use mobile deposit via your financial institution’s mobile banking app. Here are some highlights of the plan: For more details, visit irs.gov/coronavirus/ Making the Most of Your Coronavirus Economic Relief Payment Millions of Americans are getting a financial boost to help them through the economic crisis caused by the coronavirus pandemic. The federal government will be sending amounts of up to $1,200 for individuals, $2,400 for couples and $500 for children. While some people will need the money to cover immediate needs, others might consider paying down loans, reinforcing their savings or maybe even making investments. For those who are already struggling, the money will help pay for groceries, medications or other pressing needs until they can find their financial footing again. For others with a bit of financial flexibility, it might be time to start or rebuild an emergency savings fund that can be used for future unexpected needs. Ideally, experts recommend emergency savings that could last for 3 to 6 months of expenses. Any start you could make on that would be helpful. Another option for the money would be to pay down existing debt, such as credit card bills or loans. By doing this, you’ll pay less in interest fees over time, and get rid of monthly payments so you can start saving more money for future needs. If you can afford it, you could invest some of the money for the long term. While there are no guarantees, investing in the stock market can help your money grow significantly over time. But as current conditions have shown, the ride could be bumpy at times. You could also elect to spend some of the stimulus money to help your favorite small businesses that have either had to cut hours or temporarily close their doors during the pandemic. They could use that lifeline to help recover, as could local charities such as food banks or shelters. To see if you qualify for the federal stimulus, visit irs.gov/coronavirus. The money will either be directly deposited into an account at your financial institution or a check will be mailed to you. Don’t forget that you can use mobile deposit from your banking app to put the check into your account at any time of the day or night. The money is coming. Be sure to use it the best way possible to meet your needs. Coronavirus & Retirement Account Access Changes As part of the federal stimulus package to help people struggling with the economic effects of the coronavirus crisis, Americans now have options to access up to $100,000 from their retirement accounts, as either a withdrawal or a loan. The new rules apply to a range of people, including those who have lost a job or been furloughed because of the pandemic, those suffering from COVID-19, or who have a spouse or dependent with the virus. Let’s take a look at how this affects you. The changes for withdrawals from 401(k), IRA or similar employer-sponsored retirement accounts waive the normal 10% penalty on the amount of money withdrawn by people under age 59½, which will save $10,000 if you withdraw the full $100,000 limit. You’ll still have to pay income tax on the money you take out, but you can now spread that tax expense over three years and, if you repay the full amount of your withdrawal within three years, you can avoid paying those taxes. Taking a loan from your 401(k) is another option, but you’ll have to repay that amount, with interest. You can now take out a loan for up to $100,000, or 100% of your vested amount, whichever is less. People with outstanding loans due between March 27 and Dec. 31, 2020, will get an extra year to repay it. If you have you have questions about a withdrawal or loan from your retirement account, it is recommended that you talk to your retirement plan administrator. Another benefit of these changes is that retirees who are 72 or older won’t have to take a required minimum distribution from their retirement account in 2020. With the drastic stock market fluctuations and retirement funds taking a hit, this gives invested money a chance to rebuild as the stock market recovers. Individuals also have been given an extended amount of time to contribute to an IRA this year. Normally, the contribution deadline is the traditional April 15 tax-filing day, but that date has been pushed back to July 15 for 2020. Should you withdraw money from your retirement account? That is up to you and your financial situation. Some experts recommend that you look at your retirement funds as a last resort. That’s because you’re depleting the funds you have set aside for the future and will be missing out on money you could be earning when the stock market starts to recover. Coronavirus Negotiating Bill Payments In addition to our physical well-being, the coronavirus pandemic fallout has become very real to our financial health, and people are now struggling to pay bills, buy groceries and purchase prescriptions. While it’s important to keep up with your payments if at all possible, financial experts are advising people to prioritize their food and shelter needs and then to work from those points. Initially, they advise that you look closely at your budget and income, cutting unnecessary spending wherever possible in order to help make ends meet. If you’ve already done that and are still struggling, you should contact your creditors to discuss your situation, whether it be for loans or bill payments. Across the nation, financial institutions, lenders, utility and communications companies are encouraging customers to contact them about their current payment policies, which could change from month to month during the pandemic. While options will vary from lender to lender and business to business, you might find that some are extending payment deadlines, waiving late fees, lowering some interest rates, possibly deferring payments, and doing things such as suspending utility disconnections. Experts are saying to not just quit making payments without any explanation. You should personally reach out to your creditors and to explain your situation. Lenders and other businesses are asking that you contact them directly and that they will be working with people on a case-by-case basis. This includes financial institutions, credit card companies, mortgage lenders, utilities and landlords. To contact these entities, look for their customer service numbers on statements, bills, the backs of payment cards, or find contact information or live chats on their websites. Customer service departments are already warning people that wait times could be significant and are asking that you be patient. They are not kidding when they say your calls are important to them. While your payment obligations won’t just disappear, there are businesses out there willing to work with you during these trying times. Coronavirus & Tax Deadline Extended The Internal Revenue Service has given taxpayers a 3-month extension to file their 2019 federal income tax returns. Due to the coronavirus pandemic, the new deadline is now July 15, 2020, for individuals, corporations and trusts, instead of the normal April 15 filing time. The extension is automatic, so you do not have to request it. The tax payment extension applies to federal tax due with 2019 tax returns, plus 2020 first-quarter tax payments for an aggregate amount due of up to $1 million for individuals and trusts, and up to $10 million for C corporations. Any tax due in excess of these aggregate amounts is due on the normal due date and is not extended. While this allows people additional time to file, the IRS recommends that anyone who expects a refund should file as soon as possible so they have the money to meet some of their immediate financial needs. The fastest way to receive your refund would be via direct deposit into your checking account. If you choose to receive a check in the mail, consider using mobile deposit from your mobile banking app to put the money into your account as soon as you receive it. The IRS says that if you can’t meet the July 15 filing deadline, you’ll still be able to request an extension. To do that, individual taxpayers will need to file Form 4868 and businesses would file Form 7004. The IRS does not oversee state tax returns or payments and recommends that you check with your state tax agency to determine its filing and payment deadlines. To find your state revenue department search the internet using your state’s name and “income tax returns.” If you have tax-related questions about filing returns, tax payments or extensions, visit the IRS at irs.gov or talk with your tax professional for more information. Response To Coronavirus Crisis As the federal government continues to respond to the coronavirus crisis, everything from stimulus and benefit packages for individuals and businesses to health information and advice have been changing rapidly – sometimes day to day. The same goes for responses on a more local basis, whether it’s your financial institution, state or city governments, or even the places you shop or eat. With an internet connection and a computer, smartphone or tablet, there are numerous official sites where you can find the latest information that can help you economically and physically. For the latest on the federal economic stimulus plan regarding payments of up to $1,200 for individuals and $500 for children, visit the Internal Revenue Service at irs.gov, or the U.S. Treasury Department at treasury.gov. Many small businesses have been especially hard hit. Owners can visit sba.gov for details on two important plans. One is the Paycheck Protection Program and its potentially fully forgivable loan for businesses that retain or quickly rehire employees. The other is the Economic Injury Disaster Loan, which includes an advance that will not have to be repaid. Workers who have lost their jobs due to business closures or staff cutbacks should visit their state’s labor or economic security department to file for jobless benefits. To find your state’s website and to apply online, search by your state’s name and the words ‘unemployment benefits.’ In addition to federal guidelines regarding the coronavirus, many state and city governments have issued their own directives for businesses and the public. Visit those sites to learn more. A lot of businesses have had to either change their hours, change their product offerings, or temporarily close their doors. Find their websites or telephone numbers on the web for details -and find ways to support them if you are able. The coronavirus fallout has also caused a wide range of financial hardships, from paying loans, to covering your bills. Many businesses are making accommodations to help you. If you’re facing financial hardships, you should contact each of your creditors to discuss your situation. Most financial institutions have modified their hours or limited lobby access. Online and mobile banking gives you access to many services 24 hours a day. You can make loan and bill payments, transfer money, make mobile deposits, and monitor transactions online or from your mobile banking app. Visit your financial institution’s website or contact their customer service department if you have questions. Avoiding the coronavirus or seeking medical advice are major concerns for everyone. For a wide range of health advice for individuals and businesses, visit the Centers for Disease Control at cdc.gov. These are tough and confusing times but there are many things happening to address your financial and physical health. Take the time to learn how you can get help.

undefined

undefined

undefined

undefined

undefined

undefined

undefined

undefined