The Economic Impact Payment (EIP) checks are making their way to eligible taxpayers and will continue to be issued in waves over the coming weeks. The one-time EIP check is meant to ease the financial burden for the millions of Americans who quickly found themselves in an economic crisis due to the global coronavirus pandemic.

According to a recent Gallup survey, half of the recipients will use their check to buy groceries, fill prescriptions and pay bills. Others, who may still be employed or have a good financial cushion, said they will save, invest or donate the money. Depending on eligibility, the checks range from $1,200 to $2,400, plus provide $500 for children under the age of 17. Even at the minimum amount, it’s important to review the options to allocate the relief payment in a way that works to your advantage.

Making the Most of Your Economic Relief Payment

A majority of Americans are receiving a financial boost to help them through the economic crisis caused by the coronavirus pandemic. Watch this video to learn about the best ways to use your money.

Here are five suggestions for how to make the most effective use of your EIP check:

1. Pay Bills

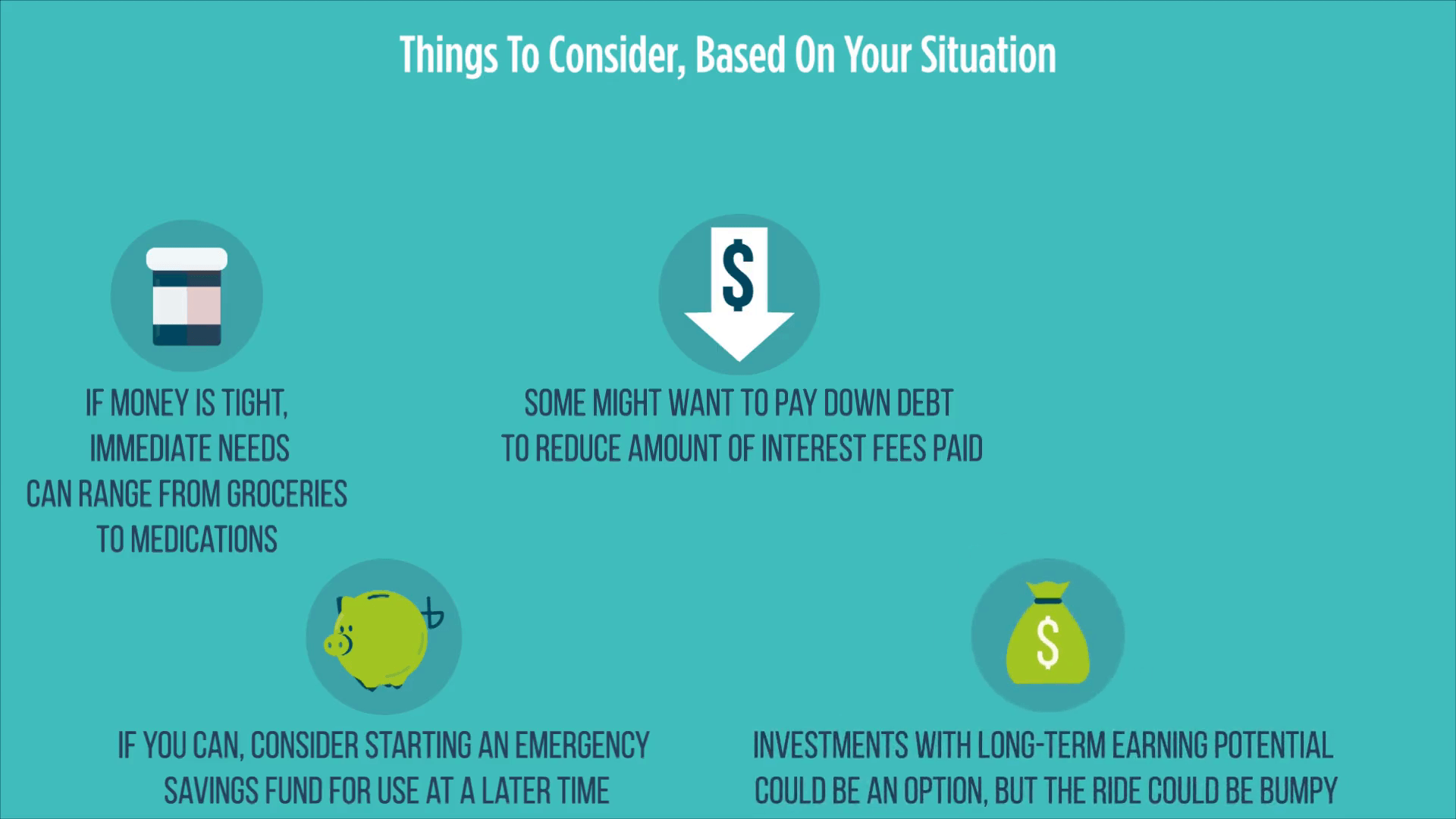

This may be the primary way many taxpayers earmark the money, especially those caught between their last paycheck and unemployment benefits. But, carefully consider which bills to pay first since many companies are offering payment deferral programs, easing shutoffs or even waiving late fees for consumers financially impacted by the pandemic. You may discover the money will cover more expenses than you thought and, even better, that you can save some of it.

2. Pay Down Debt

From credit cards to car payments and mortgages to student loans nearly everyone has some kind of debt to pay. In these extraordinary circumstances, you want to get the most value out of the relief funds you received. If you currently have no income or are receiving reduced pay, it is critical to contact all your creditors to see how they can help you. For instance, if you are eligible to participate in a mortgage deferral program, it may not make sense to use the relief funds to pay the mortgage now, but use it for another need. On the other hand, if you are financially secure, tackling credit card debt may be the best way to stretch the value of your EIP.

3. Save it

For some people this will be an opportunity to start or boost their savings or emergency funds. Even if you have a fairly solid cash flow now that could change in the coming months. Consider saving the funds to help ensure you remain prepared in the event your situation changes.

4. Make a Donation or Give a Gift

Helping someone less fortunate during this crisis may be how you use the money especially if you are in a comfortable spot. Food banks and charities that provide essential services to the community have been overwhelmed by the sharp increase in people looking for help and will need plenty of donations to meet the demand. Maybe a family member or friend lost their job and could use some extra cash to buy the essentials.

5. Invest for the Long-term

If this is a practical option for you, investing the funds for the future could be a good decision. Consider setting up a college fund or Individual Retirement Account with all or part of your EIP check.

Whether you need the money to quickly pay for the essentials or have some breathing room, take time to think strategically about how you can use the money. The goal is to get the most value from the EIP as possible. Make sure to carefully consider your short and long-term financial needs to decide what option will work best for your situation.

While we wait for our economy to get running again, you can rely on Lakeland Bank to provide our customers with access to the financial resources and services they need. Visit Lakeland Bank for the latest information related to the Coronavirus pandemic.